In the real estate industry, rental yield has long been a crucial metric for investors assessing potential deals. Traditionally, rental yield is calculated as the ratio of rental income to the property’s purchase price. However, this approach often overlooks critical cost factors, leading to an incomplete picture of an investment’s profitability. To address this gap, our startup has developed an Adjusted Long-Term (LT) Rental Yield formula that provides a more accurate assessment of real estate deals.

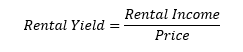

The Traditional Rental Yield Formula

The standard rental yield is calculated as:

While this formula is simple and widely used, it has significant shortcomings. It ignores key additional costs, such as refurbishment and other expenses that directly impact the investor’s return.

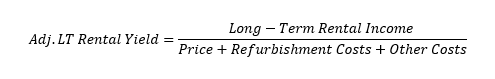

The Need for an Adjusted LT Rental Yield

The real estate market is complex, and every deal involves more than just the purchase price. Investors must account for renovation costs, transaction fees, and other expenses that influence the overall return. Our Adjusted LT Rental Yield formula addresses these limitations:

Refurbishment costs will be based on image analysis, from which we score properties based on a combination of their condition, quality, and potential. By incorporating refurbishment and other associated costs, this formula offers a more realistic and comprehensive assessment of rental property profitability.

Why This Matters for Investors and Individuals Seeking a Good Deal

- More Accurate Profitability Assessment

The adjusted formula provides a clearer financial picture, helping investors avoid misleadingly high yields that don’t account for hidden expenses. - Better Decision-Making for Both Investors and Homebuyers

Investors can make more informed comparisons between properties by considering all financial inputs rather than just the initial price. Likewise, homebuyers looking for a good deal can use this metric to assess whether a property’s price truly reflects its value, considering potential refurbishment costs. - Risk Reduction

Overlooking renovation and maintenance costs can lead to cash flow issues. Factoring these expenses into the yield calculation ensures a more stable investment strategy for investors and a more predictable cost assessment for individual buyers. - Long-Term Sustainability

Unlike short-term speculation, the adjusted yield focuses on the true long-term earning potential of a property, aligning with investors who prioritize stable and predictable returns. Similarly, individual buyers can use this metric to ensure they are making a financially sound decision when purchasing a home.

A Smarter Way to Evaluate Real Estate Investments

As real estate markets become more data-driven, it is essential to move beyond simplistic metrics. Our startup is committed to providing more accurate and reliable investment tools to ensure better decision-making for investors and individual buyers alike.

By adopting the Adjusted LT Rental Yield, real estate professionals and prospective homeowners can gain a more holistic view of rental property profitability, leading to smarter and more sustainable investment decisions.

Want to learn more? Stay tuned to our blog for more insights into how data-driven real estate investing is shaping the future!